What Is a Personal Check?

Personal checks are slips of paper that your bank issues which include the routing number of the bank along with your account number. Checks are basically written instructions ordering another financial institution or bank to transfer a certain amount from the account of the check writer to the payee–the person or company identified by the cheque. Sometimes , checks do be unable to identify a specific person however, and in this case, any person who submits the check to payment is able to get the money.

A majority of checking accounts at traditional brick and mortar banks allow you to purchase personal checks which you can make payments with. Some checking accounts are even able to provide free checks to account holders.

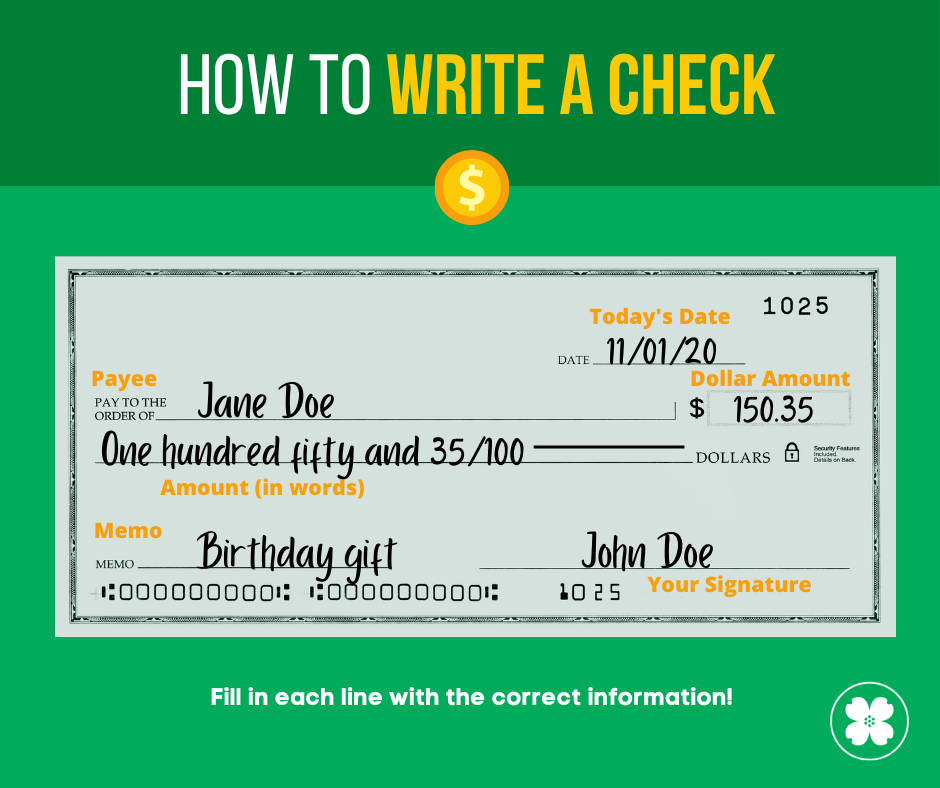

How to Write a Personal Check

Even though checks are decreasing in value as a method of payment in many circumstances that require a personal checks. Here are some things to remember if you’re required to write a traditional paper check.

- Write with black or blue ink.

- Write the current date over the date line using the format month-day-year.

- Add the payee’s name next in “Pay to the order of.”

- Inscribe the numeric amount of the check in the box by using the dollar sign (e.g., “19.99).

- Spell out the value for the “Dollar amount” line, with cents expressed in a fraction (e.g., “Nineteen dollars and 99/100”).

- Your signature will appear on the “Signature” line.

- Note a note to your payee’s “Memo” line in the lower left.

Where Can I Cash a Personal Check?

When cashing out your check in a bank make sure that they are untouched and brand new, if you need some good protection for your checks you should check out these checkbook covers that are used for protection.

If you have an individual check that you wish to exchange immediately for cash the best place to go is to a branch that is operated by the bank named on your check.

If the check was issued to one of the account holders at the bank and the account has enough funds to cover the check, and the check can be identified as the person named as the payee on the check The banks or credit unions might cash it on the spot. However, you may be subject to a charge if you don’t have an account with the bank.

You may also go to your local bank to deposit personal checks, however, you might be unable to pay checks in excess of than $200. A few retail chains and grocery stores such as Walmart, offer check-cashing service, but you’ll pay expensive fees if choosing this option. If you don’t need the cash now, put the check into your bank account and it will clear within 3 to 5 days.

What Is a Cashier’s Check?

A cashier’s cheque is a check that’s drawn from the bank’s cash instead of the account holder’s own. It’s a payment method that guarantees the recipient there will be enough funds to cover the check. However, the person requesting the cashier’s checks must first make sure that the bank has enough funds to cover the amount of the check.

Cashier’s checks offer payees the benefit of being paid reliably and immediately. That’s why they’re frequently used for major transactions including the purchase of a vehicle or the purchase of a home.

How to Get a Cashier’s Check

The only way to obtain cashier’s checks is through the bank or credit union, and you typically have to be a member of the institution in order to receive one. Some online banks let you get a cashier’s draft from your computer or phone however traditional banks might require you to go to an office. If you’re visiting in person The following is the process:

- You can take the money to fund the cashier’s check to your credit union or bank or deposit enough funds into your account.

- A government-issued photo ID and all the information needed to fill in the checks, including the payee’s name.

- When you’ve supplied the money and the name of the recipient The bank will then print the check.

- Check the details of the check, and keep the receipt so you are able to track the status of your check.

Some banks charge a cost of up to 15 dollars for cashier’s checks. Other banks offer cashier’s checks as a free service to checking account customers.